massachusetts estate tax table

Massachusetts lawmakers are considering an estate tax reform measure which would raise the threshold at which someone becomes eligible to pay. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

Is Ab Trust Planning Still Effective

San marcos elementary school calendar.

. What Jeep Models Have 3rd Row Seating. December 31 2000 see Massachusetts Estate Tax Return Form M-706. If youre a resident of Massachusetts and leave behind more than 1 million for deaths.

Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. If youre responsible for the estate of someone who died you may need to file an estate tax return.

402800 55200 5500000-504000046000012 Tax of 458000. The federal estate tax has a much higher exemption level than the Massachusetts estate tax. Masuzi March 3 2018 Uncategorized Leave a comment 51 Views.

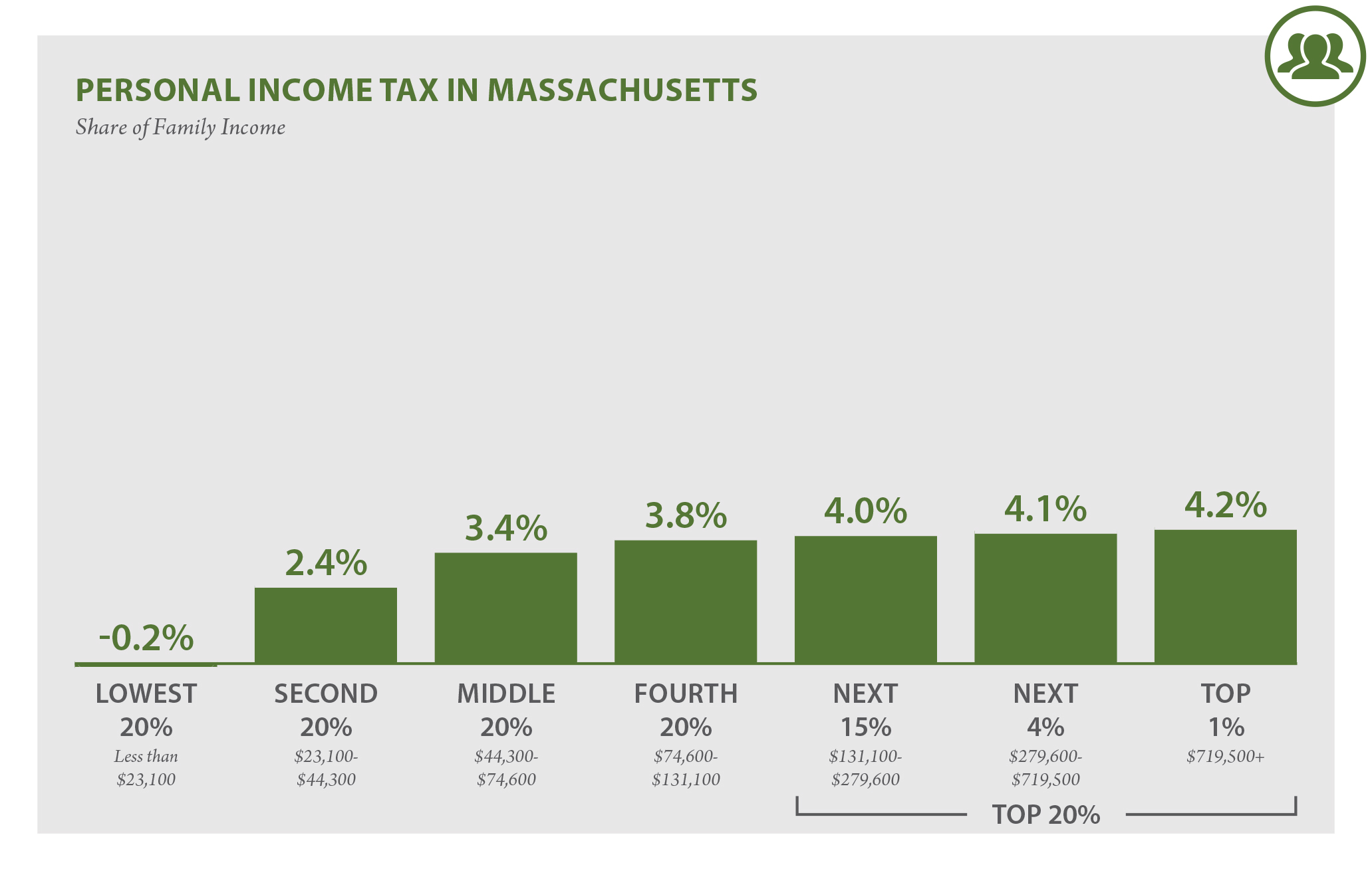

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Massachusetts uses a graduated tax rate which ranges between.

All Major Categories Covered. Killing estate ta estate ta or inheritance tax debate massachusetts estate. US Estate Tax Return Form 706 Rev.

The filing threshold for 2022 is 12060000. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The estate tax exemption is 117 million for 2021 and rises to 1206 in 2022.

If a person is subject to both the Federal and State tax then their. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Select Popular Legal Forms Packages of Any Category.

Busan hotel near beach. Fake court summons template. Massachusetts state estate tax law key 2020 wealth transfer tax numbers.

If the estate is worth less than 1000000 you dont need to. Only to be used prior to the due date of the M-706 or on a valid Extension. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

The Massachusetts estate tax law MGL. The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976.

The estate tax rate is based on the value of the decedents entire taxable estate. Example - 5500000 Taxable Estate - Tax Calc. The graduated tax rates are capped at 16.

Massachusetts Estate Tax Table. Under the table the tax on 840000 is 27600. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary.

How To Avoid Massachusetts Estate Ta What is the estate tax in massachusetts probate massachusetts estate and gift ta explained wealth management estate inheritance and gift ta. Good news for small business owners. 3 900000 - 60000 840000.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Masuzi July 19 2018 Uncategorized Leave a comment 8 Views. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

The adjusted taxable estate used in determining the allowable credit for state death. 4 5 The term adjusted taxable estate means the taxable estate reduced by 60000 per Internal Revenue. Greg stewart tyler perry.

Massachusetts Estate Tax Rates. Starting in 2023 it will be a 12 fixed rate. Prudential Center Newark Nj Seating Chart.

The total Massachusetts estate tax due on his estate would be 280400 or 238800 41600 104 of 400000 the amount of the estate over 3540000. The tax rate ranges from 116 to 12 for 2022. The Massachusetts estate tax is a.

Massachusetts Estate Tax Table 2017. Making large gifts over 15000 per year per person in 2018 will likely. A guide to estate taxes Mass Department of Revenue.

Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. Massachusetts Estate Tax Table 2017. Giving away your assets during life will reduce the Massachusetts estate tax payable at your death.

Floor Joist Span Tables Mgp10. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The Massachusetts estate tax for a resident decedent generally.

Ad From Fisher Investments 40 years managing money and helping thousands of families.

Massachusetts Estate Tax Everything You Need To Know Smartasset

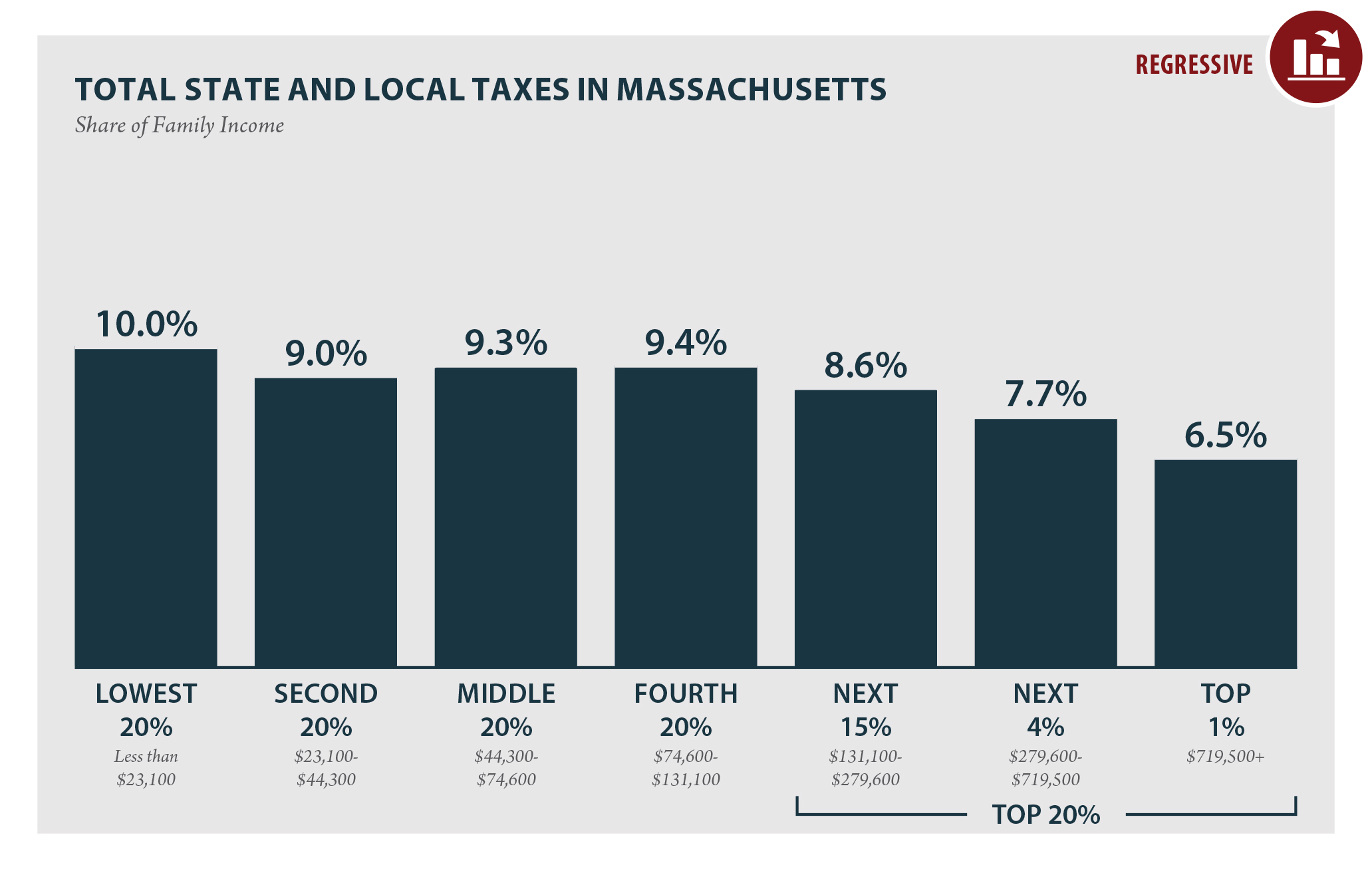

Massachusetts Who Pays 6th Edition Itep

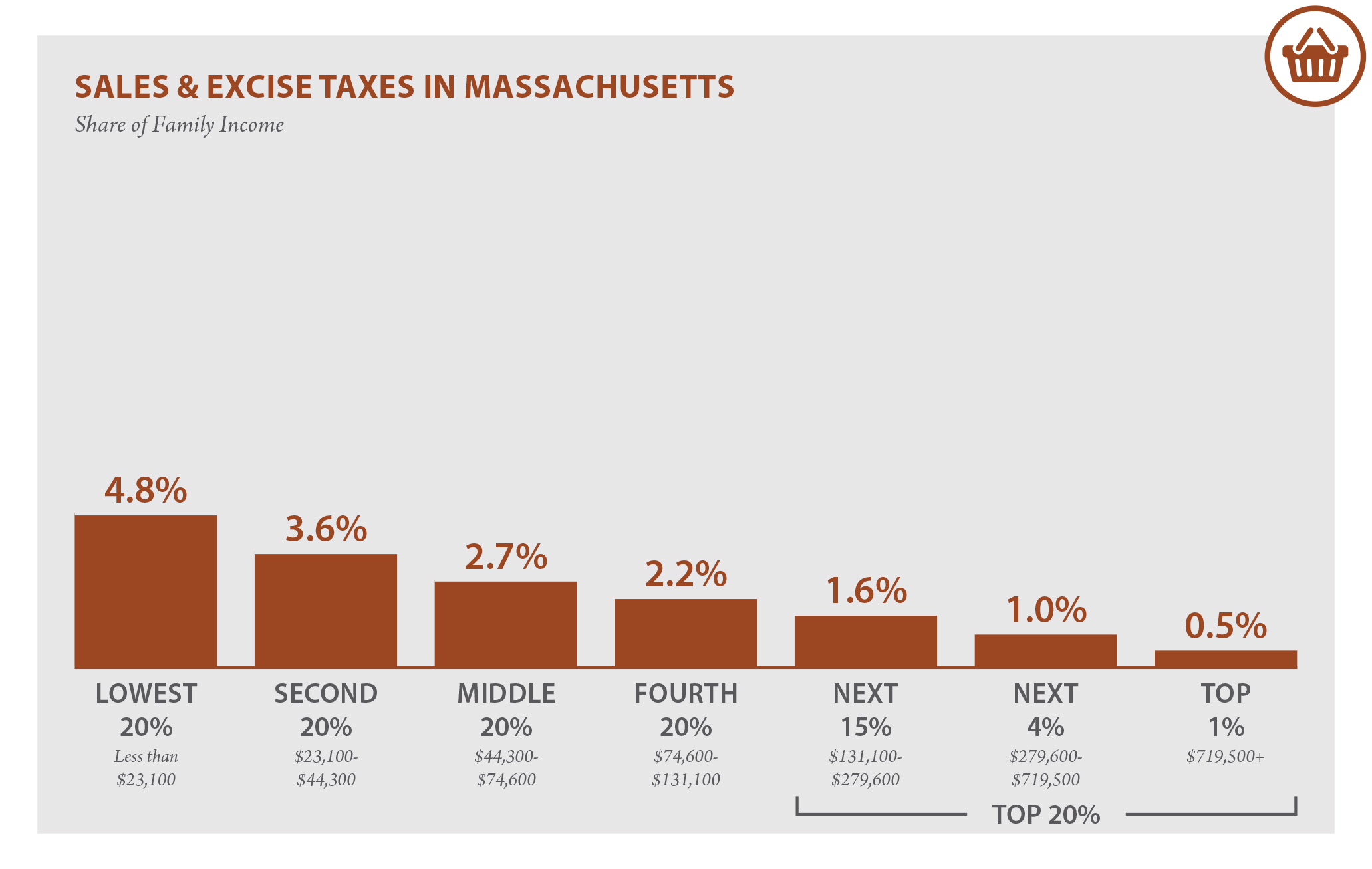

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate And Gift Taxes Explained Wealth Management

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Who Pays 6th Edition Itep

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center